You have questions. We have answers.

Everyone has questions about Medicare, whether you're looking for a plan or already using your benefits. See if your question has been answered below.

Understanding Medicare

Generally, a Medicare Advantage plan (Medicare Part C) offers more coverage than Original Medicare.

Many people think Original Medicare alone is enough coverage without realizing that it usually pays for only 80% of many costs. In general, you pay a 20% coinsurance and deductibles for services received under Medicare.

A Medicare Advantage plan may:

- Simplify your coverage, with only one benefit plan and one membership card

- Offer more benefits than Original Medicare covers

- Have different cost-sharing (for example, copays and coinsurance) than Original Medicare

- Offer out-of-pocket cost limits on some services

- Provide Part D prescription drug coverage

- Use provider networks, which means that you will generally have lower costs if you use doctors and hospitals within the plan's network.

- Charge a monthly premium in addition to the Part B premium

Medicare Advantage plans often dental coverage as part of the plans. All BCBSRI Medicare Advantage plans include dental.

There is no cost for Medicare Part A, which is hospital coverage, if you contributed to Social Security for at least 40 quarters. If you haven’t, you can purchase Medicare Part A. You do have to pay a premium for Medicare Part B, which is medical coverage. Your premium cost depends on your income.

Generally, when you turn 65, as long as you are receiving health insurance that includes credible drug coverage through you or your spouse’s employer, you do not have to enroll in Medicare Parts A and B until you stop working or lose credible drug coverage. You then have a certain amount of time, a special enrollment period, when you can enroll. But it’s important to check with your employer. They may require you to sign up for Medicare even if you are still employed.

If you are not working when you turn 65, or when you retire at any age and lose your health insurance through your employer, you need to enroll, especially in Part B. If you don’t sign up for Part B when you are first eligible, you could face a penalty.

Choosing a plan

6 steps for choosing a plan:

- Review your options. You have three basic ways to get Medicare coverage:

- Original Medicare: You can separately purchase a standalone Medicare prescription drug plan.

- Medicare Supplement: You can separately purchase a standalone Medicare prescription drug plan.

- Medicare Advantage Plan: These often include prescription coverage.

- List your healthcare needs.

- What healthcare services do you use regularly?

- How often do you see your primary care provider (PCP)?

- How many specialists do you see a year?

- Are you anticipating any special needs, such as surgery?

- After you've made your list, check to see if these services are covered in the plans you're considering and compare out-of-pocket costs such as copays, coinsurance, and deductibles.

- List your prescription drugs.

- This list will help you determine which is best for you, a standalone Medicare Prescription Drug plan or a Medicare Advantage plan that includes prescription drug coverage. Check each plan's formulary (a list of drugs that are covered) to make sure your drugs are covered. Also compare out-of-pocket costs

- List your doctors and pharmacies.

- Check to see if they participate in the networks of any plans you're considering.

- Decide whether you need out-of-network benefits.

- If you spend a significant part of the year in a second home, you need Medicare coverage that will travel with you. Check to make sure the plans you're considering allow you to receive coverage outside of their network. If you plan to travel outside the United States, make sure that your plan provides coverage for emergency care outside the country.

- Determine your budget.

- If you don't have many medical expenses, you may benefit from a plan with a low premium or no premium at all. These plans often have higher out-of-pocket expenses than plans with premiums but may be more cost-effective if you don't use many services. Be sure to compare all the costs of the plans you're considering, including premiums and out-of-pocket expenses, before making your decision.

You can find in-network doctors, dentists, and pharmacies using Find a Doctor. (Tip: Choose the plan you are considering from the list on that page.) You also can get help by calling one of our Medicare advisors.

There are a few reasons you might need out-of-network coverage:

- If you think you might need to see a specialist or use a hospital outside of the network

- If you spend a significant part of the year away from your primary home

You will want to make sure your services will be covered if you are outside of the plan's network of doctors and hospitals.

Have a look at the list of prescription drugs that are covered by your plan. It’s called a formulary. These are often divided into levels, or tiers. Drugs listed in the lower tiers cost you less.

Find 2025 formulary here

Find 2025 formulary here

If you don't have dental coverage, you should consider it. Dental work can be expensive. More importantly, regular checkups can help reveal early warning signs for other diseases. Original Medicare does not cover dental expenses. Check to see whether the plans you are considering offer additional dental coverage. All BCBSRI Medicare Advantage plans include dental coverage.

All BCBSRI Medicare Advantage plans cover routine vision office visits at $0. Benefits include allowances for eyewear.

Some BCBSRI Medicare Advantage plans include discounted hearing aid options from top brands.

We have collected all the plan materials on one page here. If you have a specific question, such as whether a certain doctor is in-network, you can call one of our Medicare advisors for the most up-to-date information.

You can view the most common copays across each of our Medicare Advantage plans here.

The simple answer is yes. But you're only able to switch your plan at certain times. The Medicare Advantage Annual Enrollment Period, from October 15 – December 7 each year, is when you can make changes to your coverage for it to be effective on January 1 of the next year. If you have had a change in your circumstance, you might be eligible for a Special Enrollment Period.

- Online – choose a plan and request a change

- Mail - complete the Plan Change Request Form in its entirety, and then mail it to:

Blue Cross & Blue Shield of Rhode Island

Attn: Medicare Advantage Membership Department

500 Exchange Street Providence, RI 02903-2699

Enrolling

Start thinking about Medicare before you are eligible. You will want to give yourself time to understand your options, ask questions, and feel confident about your choices before the deadline.

12 months before you turn 65...

- Now is the time to start looking into your Medicare plan options.

- Contact Social Security to find out about eligibility and enrollment.

6 months before…

- Contact Medicare for more information, including specific benefits and costs. (Or call BCBSRI. We’re happy to help.)

- Talk with family, friends, and doctors about your options, but remember that their situations may not be the same as yours.

- Talk with your employer about available group coverage.

- Attend a class about Medicare. BCBSRI offers age-in information sessions.

- Start comparing plans and narrow your choices.

- Check plans to see if the networks include your doctors and pharmacy.

- Make sure plans will cover you if you travel frequently or spend significant time outside Rhode Island.

- Compare out-of-pocket costs between plans.

3 months before…

Congratulations! Now you can apply for Medicare benefits through the Social Security Administration.

- You can also apply for additional coverage now. Learn about the options and easy enrollment through BCBSRI.

- Let your employer know about your decisions to ensure a smooth transition from group coverage to Medicare/retiree coverage.

- If your spouse or dependents were covered under your employer’s plan, make arrangements for them to have coverage after you have Medicare.

You’re 65!

Happy birthday! Now that you have enrolled, it’s time to make sure everything is in place:

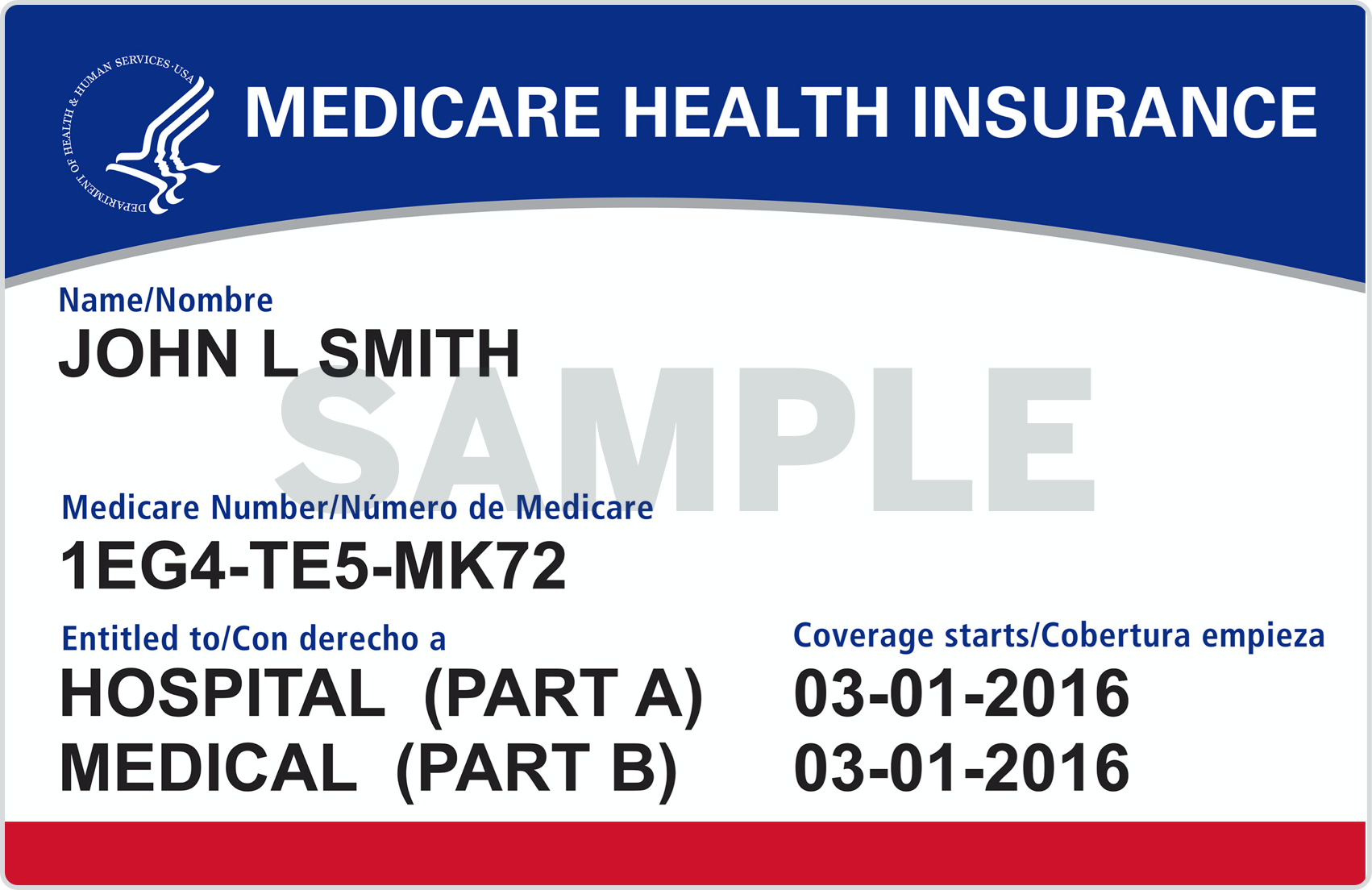

- Check that you have your red, white, and blue Medicare card.

- Make sure you have your BCBSRI member ID card and cards for any additional coverage you enrolled in.

- Tell your doctors and pharmacy about your new coverage.

You have several ways to enroll in a Medicare Advantage plan. With every choice, remember that we're always happy to help.

- On the phone

Call our enrollment line at 1-877-969-2583 (TTY: 711). - Paper form

Find enrollment forms on our documents page. Print the one you need, fill it out. and mail it back to us. - Online at Medicare.gov

You can enroll through the Centers for Medicare & Medicaid Services (CMS) Online Enrollment Center.

Absolutely! BCBSRI Medicare Specialists understand how Medicare works, so they can:

- Check to make sure you are enrolling in the plan that works best for you

- Answer all of your questions

- Help you fill out your enrollment form

Call our enrollment line at 1-877-969-2583 (TTY: 711).

BlueRI for Duals

A D-SNP is a Dual Eligible Special Needs Plan. It gives you all the benefits of Original Medicare and the extras that come with a Medicare Advantage plan. D-SNPs:

- Provide coverage for people who are enrolled in both Medicare + Medicaid

- Coordinate care and benefits between Medicare, a federal program, and Medicaid, a state program

- Help people with the highest needs cover out-of-pocket costs

- Give you all Part A and Part B benefits for $0

You must be dual eligible.* That means:

- You qualify for Medicare Part A and Part B.

- You meet the income, asset levels, and medical needs to qualify for state Medicaid.

BlueRI for Duals may be a good plan for:

- Low-income adults who are 65 years or older.

- Younger adults with disabilities.

Don’t qualify for Medicare + Medicaid, but qualify for some state or federal subsidies? Ask us about BlueCHiP for Medicare Access (HMO-POS).

*There are additional eligibility requirements. There may be other ways to qualify as well. Talk with one of our local Medicaid specialists to learn about your options.

- After qualifying life events or during the Medicare Advantage Annual Election Period (AEP: October 15 - December 7)

- If you just became eligible for a D-SNP plan, you can enroll any time

- If you have Medicaid, you become eligible for Special Election Periods (SEPs). During these times, you can join, switch, or drop your plan one time each quarter:

- January – March

- April – June

- July – September

Using your benefits

Use Find a Doctor and search for "PCP" to find a provider near you.

Pay online or by mail – your choice. View details on each option.

All BCBSRI Medicare Advantage plans have a fitness center benefit starting at $0.

Log in to myBCBSRI and you will see a button that says "Go to myPrime.com."

You can find your benefits in myBCBSRI.

You can find your claims in myBCBSRI.

Documents & forms

You will receive a new member ID card(s) in the mail prior to the start of your coverage. If any of the information on the card has changed, you will receive a new card.

You can request a new member ID card on myBCBSRI. Log in to your account (or follow the simple steps to register). Under the Self Service section, choose "Your ID Card." You can also print a temporary ID card to use until you receive your new card in the mail. Of course, you can always call the Medicare Concierge team at (401) 277-2958 or 1-800-267-0439 (TTY: 711).

Hours: Monday through Friday, 8:00 a.m. to 8:00 p.m.; Saturday, 8:00 a.m. to noon. (Open seven days a week, 8:00 a.m. to 8:00 p.m., October 1 – March 31.) You can use our automated answering system outside of these hours.

Call the Medicare Concierge team as soon as possible at (401) 277-2958 or 1-800-267-0439 (TTY: 711).

Hours: Monday through Friday, 8:00 a.m. to 8:00 p.m.; Saturday, 8:00 a.m. to noon. (Open seven days a week, 8:00 a.m. to 8:00 p.m., October 1 – March 31.) You can use our automated answering system outside of these hours.

You will receive several mailings from BCBSRI, especially in October, just before the Annual Enrollment Period when you can change your coverage.

- Annual Notice of Changes (ANOC) – This document contains any benefit changes to your plan from the previous year.

- Evidence of Coverage (EOC) – This document contains details about your Medicare health care and prescription drug coverage for the current plan year.

- Provider directory – This is a comprehensive list of all of the providers in the Medicare Advantage network.

- Summary of benefits – This is a quick summary of the key benefits of your Medicare Advantage plan.

We have collected almost any form you will need on our forms page. If you don't find what you need, our Medicare Concierge team is always happy to help.