Save when you renew with BCBSRI

Offering competitive employee benefits has never been more important—yet so is managing your healthcare expense. Here are four ways you can enhance your benefits offering while saving money and improving the health of your company.

Earn up to 8% back on your premium with Wellness Premium Reward

That could be as much as $27,000 in rewards sent back to you annually, based on the average 25-employee company. There’s no added cost (it’s part of your health plan), and employees can earn up to $200 in rewards annually, based on their healthy activities.

Start earning

Uncover big savings potential with Group Medicare

With HealthMate Coast-to-Coast for Medicare Group (PPO), you could take advantage of an overall average savings of $10,985 PMPY1 versus offering retirees a commercial plan. Your retirees will get richer benefits and could save on monthly premiums—all from a name they know and trust.

See the savings

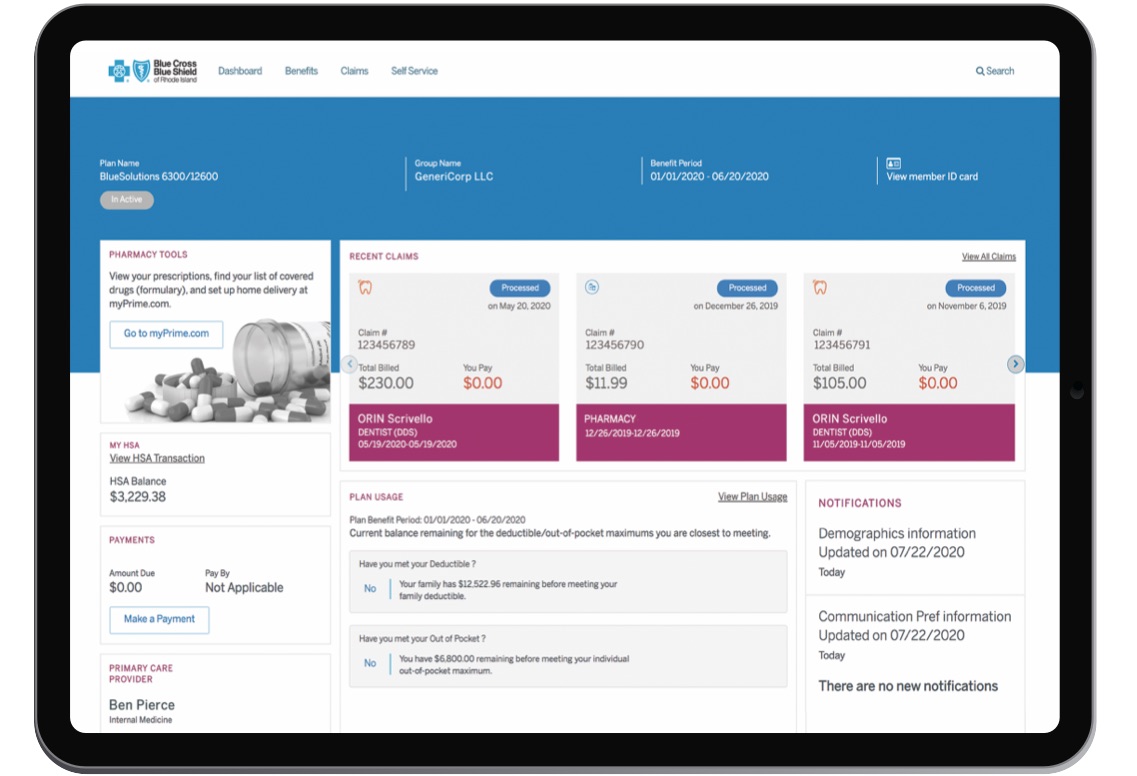

Reduce administrative workload with myBCBSRI

With myBCBSRI, employees can self-manage plan information—online or on the app—including:

- Confirming coverage

- Tracking claims

- Reviewing deductibles

- Finding a doctor or procedure cost

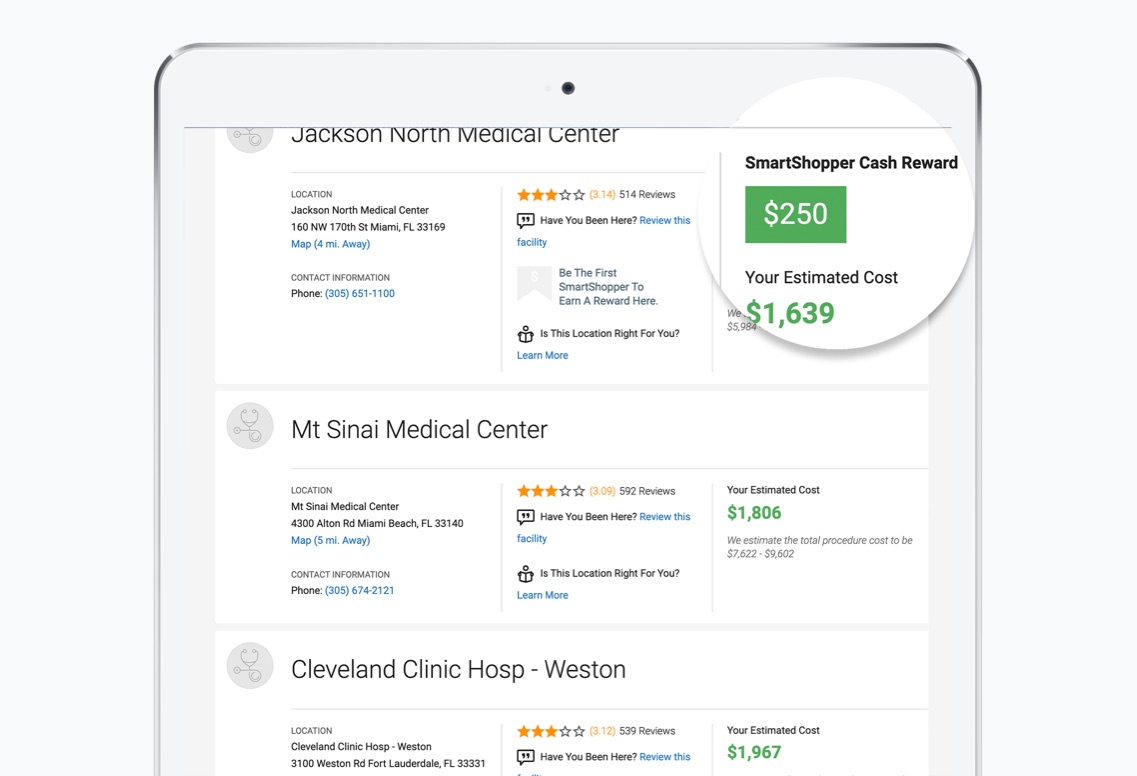

Encourage smarter healthcare choices

SmartShopper® lets employees compare in-network providers for routine services and earn cash rewards for choosing a quality, cost-effective option.2 They become more savvy healthcare consumers, and you can lower your costs trends over time.

Get the details1Estimated annual savings based on average BCBSRI 2023 Small Group fully insured commercial plan premium for members who are 65+ years old and average BCBSRI 2022 Employer Medicare Advantage premium. Estimated savings provided above are for illustrative purposes only and are not intended to represent or guarantee that any individual employer group will achieve the same or similar results.

2The SmartShopper program is offered by Sapphire Digital, an independent company. Incentives available for select procedures only. Payments are a taxable form of income. Rewards may be delivered by check or an alternative form of payment. Members with coverage under Medicaid or Medicare are not eligible to receive incentive rewards under the SmartShopper program. SmartShopper is not available for BCBSRI’s fully insured HSA-qualified high deductible health plans, such as BlueSolutions for HSA.